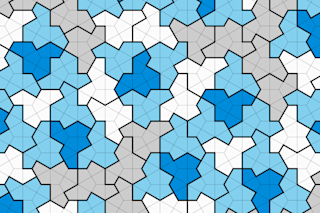

V(x,p) = v(x)w(p)

People hate losing money about twice as much as they love making it: It takes a $20 discount, researchers have found, to make up for the sting of a $10 surcharge on a purchase. That is one reason why even experienced stockbrokers often sell stocks while they are still increasing in value, leaving money on the table rather than risking a loss.

Prospect theory’s central formula lays out how we go with our gut when determining the value (V) of a possible outcome (x) with a given probability (p). It takes into account many of people’s most predictable — and, at times, peculiar — financial irrationalities: shying away from losses, for instance, and overestimating tiny probabilities like the 1-in-10-million chance of winning the lottery.

N(t) = N0e-λt

In 1899 Ernest Rutherford noticed that half of the atoms in a sample of radioactive radon gas disappeared with each ...